[ad_1]

When the Sage of Omaha, Warren Buffett, bets on gold miners, you sit up and take discover. Bear in mind, betting on gold miners is riskier than betting on gold in case you worry you’re close to the highest of the cycle however way more rewarding in case you suppose there’s extra runway forward—as miners make outsized earnings when the yellow steel features, however the reversal is as sharp when the tide turns. So gold mining shares would are likely to outpace gold on the way in which up and down.

There’s one more reason to be betting selectively on gold miners: elevated scrutiny on greenhouse emissions by ESG traders may harm the much less compliant and crimp their output. However that’s one other debate altogether.

Coming again to the case for gold, the unprecedented cash printing within the wake of the COVID-19 pandemic raises the spectre of inflation and forex devaluation globally, which makes the yellow steel a very good candidate as a retailer of worth.

(Financial concept means that as cash provide in an financial system will increase, it causes costs to rise – as extra money chases the identical variety of items and property. Excessive inflation renders the financial system much less aggressive than others, resulting in a devaluation of its forex. Gold derives its worth partially from the truth that it has been used as a forex traditionally, and since sufficient folks imagine it’s nonetheless a retailer of worth. In consequence, it tends to rise in periods of uncertainty or when there may be excessive inflation or worry of it.)

Underneath such circumstances, and with the US Federal Reserve indicating that it’ll not up rates of interest for at the least one other 2-3 years and until inflation tops 2 p.c, there’s a must hedge in opposition to rising inflation and destructive actual rates of interest.

In actual fact, Goldman Sachs’ Chief Commodity Strategist, Jeffrey Currie, has projected gold to scale to $2,300 on expectations of upper inflation and the chance of greenback dropping its reserve forex standing.

END OF THE DOLLAR REIGN?

In actual fact, that’s one of many greatest raging debates in latest occasions: will the greenback lose its present reserve forex standing? Reserve currencies are principally currencies that nations preserve with them to facilitate worldwide commerce, with the US greenback being the dominant medium of trade (about 60 p.c of world commerce).

However to know how this got here to be, it helps to take a brief stroll again in time.

From 1816 to 1914, the world principally used gold as the usual for trade — and central banks printed currencies to the extent of reserves of gold that they had of their possession.

That interval noticed few monetary crises — although some argue that the monetary stability was the explanation why the gold commonplace continued effectively as a substitute of the opposite manner round.

The interval between the World Wars until 1939 noticed nations observe a blended framework of gold commonplace and floating charges.

It additionally noticed the UK being displaced by the US because the monetary powerhouse. The Nineteen Forties noticed a post-war financial system evolve with the Bretton Woods Settlement coming into play in 1944 with 42 nations agreeing to an adjustable dollar-peg for his or her currencies. The settlement additionally led to the establishing of the World Financial institution and Worldwide Financial Fund.

However gold nonetheless performed a job as trade for forex, and this was halted by US President Richard Nixon in 1971 to stop depletion of the nation’s gold reserves. Thus the greenback was lastly unhinged from gold. This was adopted by the US and UK suspending capital controls in 1974 and 1979, respectively. Thus the current managed floating fee trade system that exists in the present day got here into being.

However is the present system sturdy sufficient to proceed for a couple of extra a long time? Is that this then the top for the greenback as we’ve recognized it? These are zillion-dollar questions. Apparently, and this not my remark however borrowed knowledge, the trade programs have traditionally lasted for 30-40 years. So it might simply be time for an additional reset. And if that’s the case, it makes much more sense to maintain some cash in hedges like gold, or bitcoin.

GOLD OR BITCOIN?

Bitcoin is being positioned as the brand new digital gold. And of late, its legitimacy has leaped with a number of institutional traders, even pension funds, transferring a part of their allocation from gold to bitcoin. That’s optimistic bitcoin and destructive gold. However right here it is very important notice that gold nonetheless stays the large wager, and Bitcoin for many is barely a nominal diversification—although even that’s huge cash to gas a bitcoin rally.

In a latest Greed & worry notice by Jefferies’ Chris Wooden, he argues for an allocation by pension funds to bitcoin, whereas retaining the religion in gold. To cite: “…introduce an funding in Bitcoin in GREED & worry’s lengthy solely international portfolio for US dollar-denominated pension funds…. The 50% weighting in bodily gold bullion within the portfolio can be diminished for the primary time in a number of years by 5 share factors with the cash invested in Bitcoin”. On the case for gold, it provides: “the yellow steel ought to rally once more if the Fed stays doveish within the face of the dramatic cyclical restoration that’s approaching the opposite facet of the pandemic… GREED & worry’s base case is that the Fed stays doveish even when solely as a result of the system can’t afford larger charges”.

| JEFFERIES’ LONG-ONLY PENSION FUND PORTFOLIO ALLOCATION | |

| Funding kind | Weight (%) |

| Bodily gold bullion | 45% |

| Asia ex-Japan equities, weighted based on the long-only thematic portfolio | 30% |

| Unhedged gold mining shares | 20% |

| Bitcoin | 5% |

Right here it’s fascinating to notice Jefferies’ portfolio allocation, which has an outsized publicity to gold—bodily and by way of mining shares—of 65% and solely 30% in equities.

And whereas I’m nonetheless unconvinced about bitcoin—I desire gold palms down—a small publicity on grounds of FOMO (or worry of lacking out) inside the hedge allocation might not be imprudent, particularly given the institutional endorsement.

THE CASE FOR INDIAN GOLD

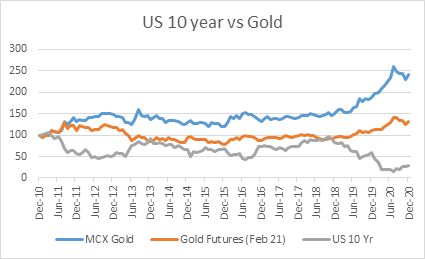

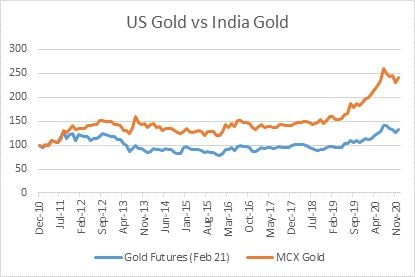

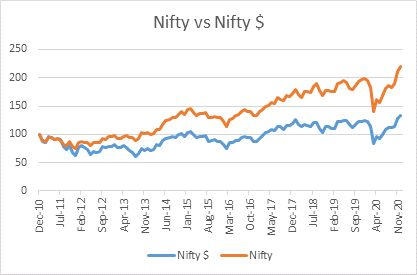

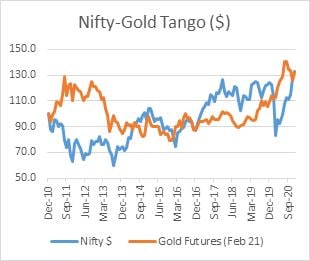

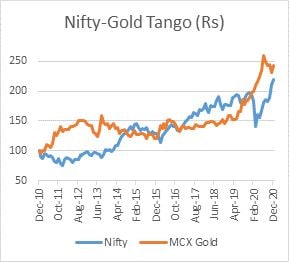

To try to perceive investing in gold higher and the related dangers, we did some evaluation of its historic habits over the previous decade. Right here’s what we discovered: gold pipped the Nifty in rupee returns, gold has a destructive correlation with US rates of interest (or inflation) and gold features when the Re slips in opposition to the US$.

| HOW GOLD CORRELATES | |||||

| Gold Spinoff | US 10 Yr | $ Index | USD/INR | Nifty $ | Nifty |

| US Gold Futures | -0.6 | -0.3 | 0.1 | ||

| MCX Gold | -0.74 | 0.37 | 0.67 | 0.59 | |

| RETURNS (10 Yr CAGR) | |

| Instrument | % |

| USD/INR | 5.16 |

| US Gold Futures | 2.88 |

| MCX Gold | 9.25 |

| Nifty | 8.22 |

What is obvious from the above is that gold acts as a hedge in opposition to forex danger and this helps it ship larger rupee returns. What’s additionally fascinating to notice is that Indian gold and the Nifty are positively correlated. Apparently, even within the case of Nifty, whereas the rupee returns had been above 8 p.c on a 10-year compounded foundation, the returns for the Nifty US$ had been below 3 p.c.

Nevertheless, gold is clearly the higher hedge in opposition to forex and fee danger. And within the present context the place we’re more likely to see inflation begin to rise however a lag in fee motion by the US Federal Reserve and different central banks, in addition to extra money printing, with extra stimulus within the works, the case for gold turns into stronger.

In actual fact, an alternative choice to taking some cash from equities (given the lofty valuations) and changing it into money, or close to cash-holdings, like many traders are doing can be to speculate some such sums in gold.

[ad_2]

Source link