[ad_1]

Why do you consider what you consider?

If you happen to select the buying and selling life, you’ll have to cope with these existential questions, “Who do you selected to consider, why do you consider what you consider, how a lot of that’s already priced in and what are you going to do if you’re improper?”

When it comes to, “who do you selected to consider,” evidently the opposing views we hear nowadays from “considerate” persons are extra strident than ever – whether or not the variations of opinion are over markets, the economic system, social or political points. For the needs of a Buying and selling Desk dialogue, I’ll concentrate on what individuals selected to consider about markets whereas acknowledging that these different points additionally have an effect on markets.

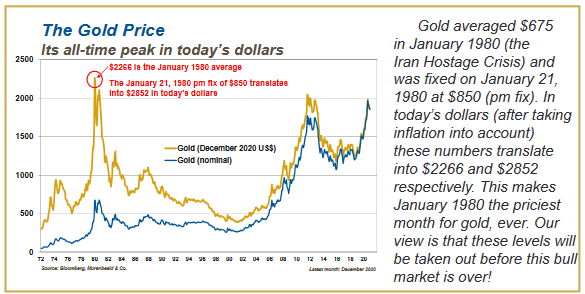

I used to be at a gold convention years in the past when a preferred speaker yelled from the rostrum that gold was going to the moon. A thousand individuals within the room erupted with yells of settlement. I puzzled if there was any distinction between being bullish gold since you thought it was going up and being bullish gold since you owned gold.

Folks consider what they wish to consider

I’ve observed that in markets, and elsewhere, that individuals select to consider individuals who reinforce beliefs they already maintain. Some people describe this as tribal conduct. My thought is that this tribal conduct might create biases that impair cognitive skill, that individuals will align their funding conduct with what they “like” whereas purposefully discounting or ignoring issues they don’t “like.”

For example, the key inventory indices have been at or close to All Time Highs on the finish of 2020. The and the indices have been up ~65% from their March lows. Many standard market analysts consider that the indices will proceed to pattern greater in 2021, for quite a lot of causes together with the concept that vaccines will convey in regards to the finish of lockdowns and “pent up” demand will ignite an financial increase which is able to in flip encourage inventory costs to soar.

DJIA Weekly Chart

How a lot of your perception is already available in the market?

Honest sufficient. However on condition that markets are continually discounting the long run, how a lot of that bullishness is already priced in? I’ve no approach of realizing however through the years I’ve seen “purchase the rumor, promote the information” play out many occasions.

Many individuals desire a “prediction” of the long run that “is sensible” to them and they’re going to use this forecast to assemble their buying and selling/funding technique. Remember that “predictions” are sometimes advertising ploys, not analysis.

Believing in predictions may not be a superb technique

I keep in mind within the 1970’s there have been a number of predictions in regards to the Darkish Future that was going to engulf the world due to runaway inflation and/or the Chilly Warfare turning Sizzling. Folks have been shopping for dehydrated meals, silver cash, weapons and ammo and constructing bomb shelters.

Possibly believing predictions a few market, particularly when you tune out anyone who doesn’t agree along with your perception, just isn’t the easiest way to take part in a market. When a market goes your approach you may really feel vindicated for “having the braveness of your convictions,” however what’s going to you do if/when the market turns in opposition to you?

What do you do if you’re improper?

What’s going to you do if you’re improper? How will you already know if you’re improper? Will you are taking it “personally” or will you simply get out and transfer on to no matter is subsequent?

A couple of weeks in the past I used this quote (wrongly) attributed to Mark Twain to explain a HUGE market danger: “It ain’t what you don’t know that will get you into hassle, its what you already know for certain that simply ain’t so.” Please preserve that in thoughts when you’re making buying and selling selections.

Market motion and consensus expectations

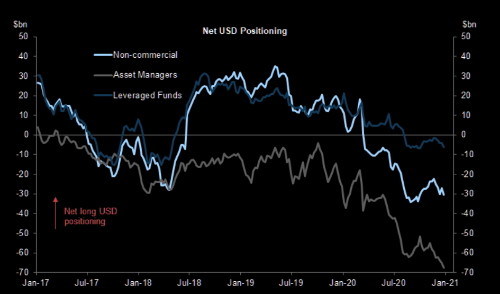

The ended 2020 at 32-month lows. Since March the downtrend within the USDX has had a powerful adverse correlation to the rally in equities and commodities. THE pro-risk commerce the previous a number of months was quick the USD, lengthy shares and lengthy commodities. That’s actually a really crowded commerce as we go into the brand new yr.

Greenback Index Weekly Chart

Web USD Positioning

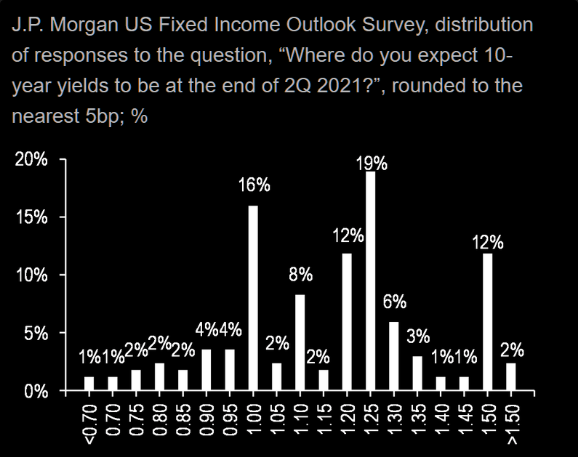

Inflation and rates of interest are broadly anticipated to rise in 2021.

Why Do You Imagine What You Imagine? If You Select The Buying and selling Life, You Will Have To Deal With These Existential Questions, “Who Do You Selected To Imagine, Why Do You Imagine What You Imagine, How A lot Of That Is Already Priced In And What Are You Going To Do When You’re Improper?” In Phrases Of, “Who Do You Selected To Imagine,” It Appears That The Opposing Views We Hear These Days From “Considerate” Folks Are Extra Strident Than Ever – Whether or not The Variations Of Opinion Are Over Markets, The Financial system, Social Or Political Points. For The Functions Of A Buying and selling Desk Dialogue, I Will Focus On What Folks Selected To Imagine About Markets Whereas Acknowledging That These Different Points Additionally Have An Affect On Markets. I Was At A Gold Convention Years In the past When A Standard Speaker Yelled From The Podium That Gold Was Going To The Moon. A Thousand Folks In The Room Erupted With Yells Of Settlement. I Puzzled If There Was Any Distinction Between Being Bullish Gold As a result of You Thought It Was Going Up And Being Bullish Gold As a result of You Owned Gold. Folks Imagine What They Need To Imagine I Have Seen That In Markets, And Elsewhere, That Folks Select To Imagine Folks Who Reinforce Beliefs They Already Maintain. Some Of us Describe This As Tribal Conduct. My Thought Is That This Tribal Conduct Could Create Biases That Impair Cognitive Capacity, That Folks Will Align Their Funding Conduct With What They “Like” Whereas Purposefully Discounting Or Ignoring Issues They Don’t “Like.” For Occasion, The Main Inventory Indices Had been At Or Close to All Time Highs At The Finish Of 2020. The DJIA And The S+P 500 Indices Had been Up ~65% From Their March Lows. Many Standard Market Analysts Imagine That The Indices Will Proceed To Development Larger In 2021, For A Selection Of Causes Together with The Thought That Vaccines Will Carry About The Finish Of Lockdowns And “Pent Up” Demand Will Ignite An Financial Increase Which Will In Flip Encourage Inventory Costs To Soar. How A lot Of Your Perception Is Already In The Market? Honest Sufficient. However Given That Markets Are Continuously Discounting The Future, How A lot Of That Bullishness Is Already Priced In? I Have No Means Of Realizing However Over The Years I Have Seen “Purchase The Rumor, Promote The Information” Play Out Many Instances. Many Folks Need A “Prediction” Of The Future That “Makes Sense” To Them And They Will Use This Forecast To Assemble Their Buying and selling/funding Technique. Hold In Thoughts That “Predictions” Are Usually Advertising Ploys, Not Analysis. Believing In Predictions Would possibly Not Be A Good Technique I Keep in mind In The 1970’s There Had been A Lot Of Predictions About The Darkish Future That Was Going To Engulf The World As a result of Of Runaway Inflation And/or The Chilly Warfare Turning Sizzling. Folks Had been Shopping for Dehydrated Meals, Silver Cash, Weapons And Ammo And Constructing Bomb Shelters. Possibly Believing Predictions About A Market, Particularly If You Tune Out Anyone Who Does Not Agree With Your Perception, Is Not The Finest Means To Take part In A Market. When A Market Is Going Your Means You Would possibly Really feel Vindicated For “Having The Braveness Of Your Convictions,” However What Will You Do If/when The Market Turns In opposition to You? What Do You Do When You’re Improper? What Will You Do When You’re Improper? How Will You Know When You’re Improper? Will You Take It “Personally” Or Will You Simply Get Out And Transfer On To No matter Is Subsequent? A Few Weeks In the past I Used This Quote (Wrongly) Attributed To Mark Twain To Describe A HUGE Market Threat: “It Ain’t What You Don’t Know That Will get You Into Hassle, Its What You Know For Certain That Simply Ain’t So.” Please Hold That In Thoughts When You Are Making Buying and selling Choices. Market Motion And Consensus Expectations The US Greenback Index Ended 2020 At 32-Month Lows. Since March The Downtrend In The USDX Has Had A Sturdy Damaging Correlation To The Rally In Equities And Commodities. THE Professional-Threat Commerce The Previous A number of Months Was Quick The USD, Lengthy Shares And Lengthy Commodities. That Is Definitely A Very Crowded Commerce As We Go Into The New 12 months. Inflation And Curiosity Charges Expectations

Fastened Revenue Outlook Survey

The small cap index rallied as a lot as 30% from the start of November by way of year-end. It was up ~110% from the March lows whereas the was solely up ~95%.

Emini Russell 2000 Each day Chart

and had spectacular rallies this yr. The rallied to 6-year highs.

Soybeans Each day Chart

Lumber Each day Chart

Continous Commodity Index Month-to-month Chart

The rallied from round 68 cents in March to almost 79 cents in December. Credit score the weak USD and rising commodity costs.

CAD Weekly Chart

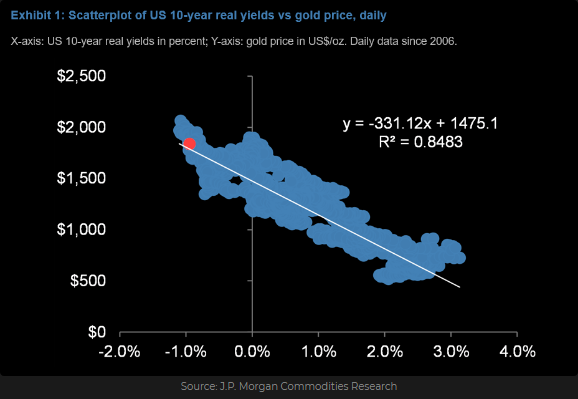

has been extremely correlated with falling actual rates of interest for the reason that 2018 lows and made a brand new All Time nominal excessive in August ~$2050.

US 10 Yr Actual Yields Vs Gold Worth Each day Chart

This gold chart, courtesy of my good pal Dr. Martin Murenbeeld, reveals that in as we speak’s {dollars} the 1981 excessive was ~$2850.

The Gold Worth Chart

Finest needs to all my readers for good well being and good buying and selling in 2021.

[ad_2]

Source link